By phone at 1-800-959-5525. File taxes and get tax information for individuals businesses charities and trusts.

Each jurisdiction has the right to tax the income of its own residents under their own domestic laws so the tax treaty will not always restate this rule.

Taxes au canada. Ad 978 Customer Satisfaction. Ask the Financial Experts at Just Answer Anything Online. File taxes and get tax information for individuals businesses charities and trusts.

Income tax GSTHST Payroll Business number Savings and pension plans Child and family benefits Excise taxes duties and levies Charities and giving. Type of tax Amount Percentage of total tax revenue. Consumption sales taxes.

Social security contributions. Income taxes personal and corporate 265403. Common types of taxes are income taxes sales taxes property taxes and business taxes if you own a business.

The Canada Revenue Agency CRA collects income taxes. Each year people who are Canadian residents for tax purposes complete an income tax return. On this return you list your taxable income deductions and tax credits to calculate how much tax you owe.

If the full value of your items is over 20 CAD the import tax on a shipment will be 5. For example if the declared value of your items is 20 CAD in order for the recipient to receive a package an additional amount of 100 CAD in taxes will be required to be paid to the destination countries government. This tool provides an estimate only and applies strictly to goods imported for personal use.

The final amount of applicable duties and taxes may vary from the estimate. The amount you have to pay will be determined by a border services officer when you arrive at the border. For more information including personal exemption amounts consult Paying.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month. Your average tax rate is 220 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. In Canada tips are never included in the price.

Even though a tip should depend on the quality of the goods or services received it is the custom in Canada to give a tip equivalent to 15 of the total bill befores taxes in restaurants bars and taxis. You can leave the. Taxes on trading in Canada can be split into two distinct brackets.

The first falls under the capital gains tax regime. The second and most applicable to day traders is in regard to business income. Generally the federal goods and services tax GST applies to taxable goods and services supplied in Canada.

The harmonized sales tax HST is a blended federalprovincial sales tax that includes a 5 percent federal component and a provincial component of 8 percent or 10 percent. HST applies in the provinces of Ontario New Brunswick Nova Scotia. If you are self-employed the CRA gives you a bit longer to submit your income tax return you do not have to submit it until June 15.

However if you owe tax the CRA will apply interest to the balance owing as of April 30. Due Dates for Installment Payments. Individuals must file their income tax returns by April 30th every year.

As long as you file and pay by then you will not incur interest or. Each jurisdiction has the right to tax the income of its own residents under their own domestic laws so the tax treaty will not always restate this rule. If the jurisdiction of residence has the sole taxing right over certain types of income profits or gains this is usually expressed as shall be taxable only in that country.

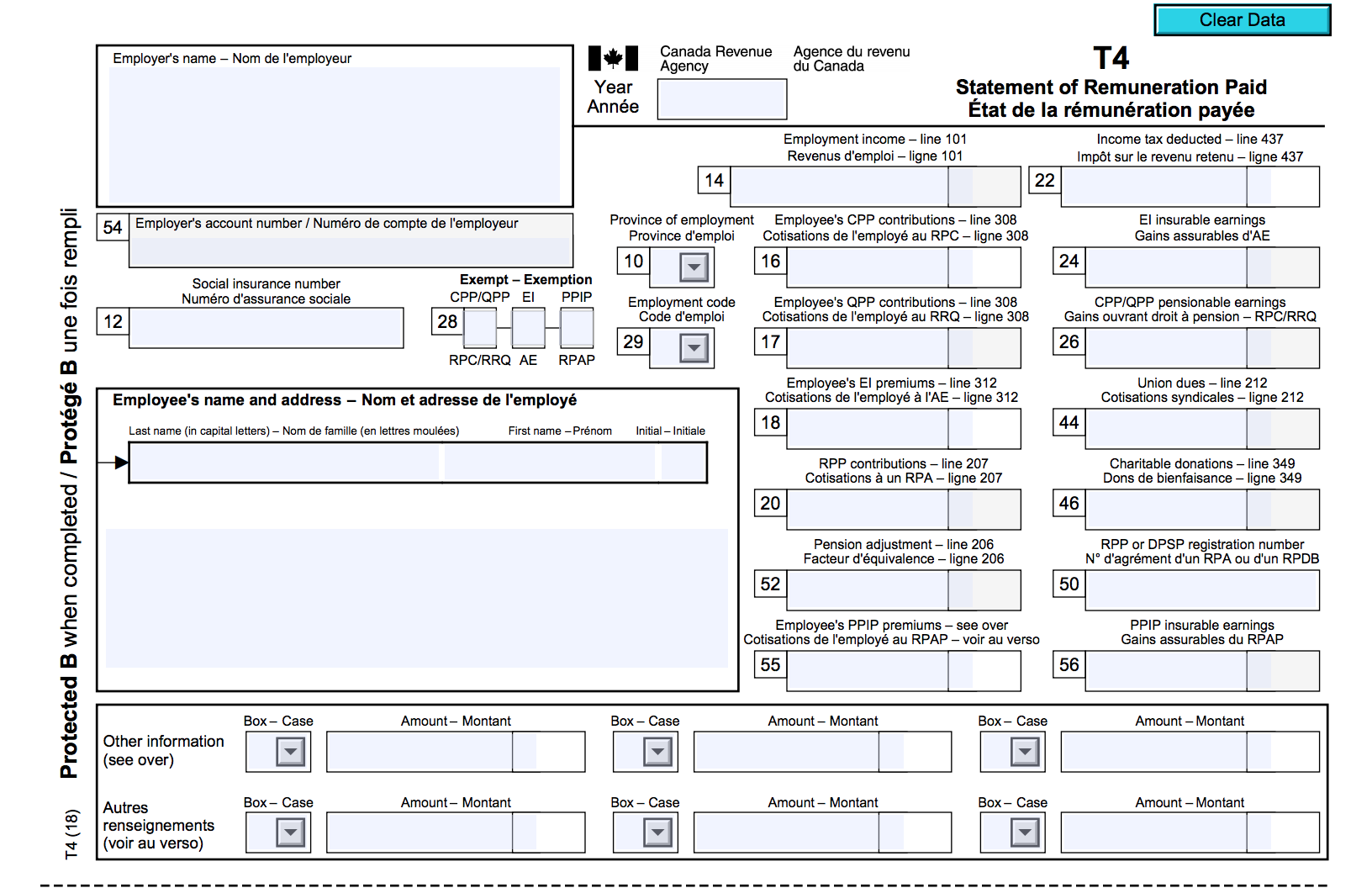

2017 marks Canadas 150th birthday and the 100th anniversary of the Income Tax Act. Watch our video that highlights the history and importance of the Income. Canada with income tax filing obligations or in respect of whom an information return is to be made is required to have or obtain a SIN.

SINs are confidential but are required to be furnished on request to financial institutions for tax reporting. Telephone 1 416 367 6149. Tax Specialism MA Tax Transfer Pricing.

See our other areas of work. Select an area of work Compensation Tax Energy Tax Financial Services Indirect Tax MA Tax Private Client Services Real Estate Tax Tax. Find professional Income Taxes Canada videos and stock footage available for license in film television advertising and corporate uses.

Getty Images offers exclusive rights-ready and premium royalty-free analog HD and 4K video of the highest quality. The first step to filing a tax return is to obtain a Social Insurance Number from Service Canada or an individual Tax Number from the Canada Revenue Agency. Canadian residents should then complete their tax return with the General Income Tax and Benefit package of the province in which resided on Dec.

31 of the tax year. Online using the CRA Business Registration Online BRO service. By phone at 1-800-959-5525.

You will have to verbally answer the questions from form RC1. By filling out form RC1 Request for a Business Number BN and mailing or faxing it to the nearest tax service office or tax center. A 5 dividend WHT rate applies to franked dividends paid by an Australian resident company and in the case of dividends paid by a Canadian resident company other than a non-resident owned investment corporation to a company that directly holds at least 10 of the voting power in the dividend company although note that Australia does not impose WHT on franked dividends.

The existing taxes to which this Convention shall apply are. A in the case of Australia. The income tax and the resource rent tax in respect of offshore projects relating to exploration for or exploitation of petroleum resources imposed under the federal law of Australia.

B in the case of Canada. Ad 978 Customer Satisfaction. Ask the Financial Experts at Just Answer Anything Online.