Plus particulièrement le doublement progressif des prestations du Régime de pensions du Canada RPC et du Régime de rentes du Québec RRQ les faisant passer de 25 p. Her Excellency the Governor General in Council on the recommendation of the Minister of Finance pursuant to subsections 4 6 and 9 6 and section 39 of the Pension Benefits Standards Act 1985.

In Canada Repurchase agreements repos enable financial market.

Pension canada montant. Table 1 - Guaranteed Income Supplement GIS amounts for an income range of 43200 to 86399. Si le montant du paiement de John est de 54989 par mois son paiement mensuel accru serait de 59608. Autres situations qui peuvent affecter le montant de votre pension de la Sécurité de la vieillesse Si vous avez vécu au Canada moins de 40 ans.

Tout le monde ne reçoit pas la pension complète de la Sécurité de la vieillesse. Pour obtenir le montant de pension de vieillesse spécifique à votre situation consultez la calculatrice de revenu de retraite fédérale. Comment calculer sa retraite au Québec.

En plus des pensions de vieillesse du Canada le montant de votre retraite au Québec sera calculé en fonction de votre cotisation au Régime des rentes du. The amount of a retirement pension under the Québec pension Plan depends on your age when you begin receiving your retirement pension the number of years you contributed to the Plan and the employment earnings on which you contributed. It is adjusted according to whether payment of your pension begins before or after your 65th birthday.

Type de prestation du Régime de pensions du Canada. Montant mensuel maximal des prestations pour 2016. Pension de retraite à 65 ans 1 09250 Prestation après retraite à 65 ans.

Designated pooled pension plans Régime de pension collectif désigné A designated pooled pension plan DPPP is defined in the ITA to be a pooled pension plan PPP that at any time in a calendar year. Has fewer than 10 participating employers except in the year of registration. Holds more than half of its property by fair market value for employees of a single employer.

Or has a plan. In Canada Repurchase agreements repos enable financial market. Au cours des dernières années et leur montant se situe maintenant.

1Les mises en pension sont analogues aux prises en pension spéciales de la Banque du Canada mécanisme par lequel. PENSION BENEFITS STANDARDS ACT 1985. Regulations Respecting Pension Benefits Standards.

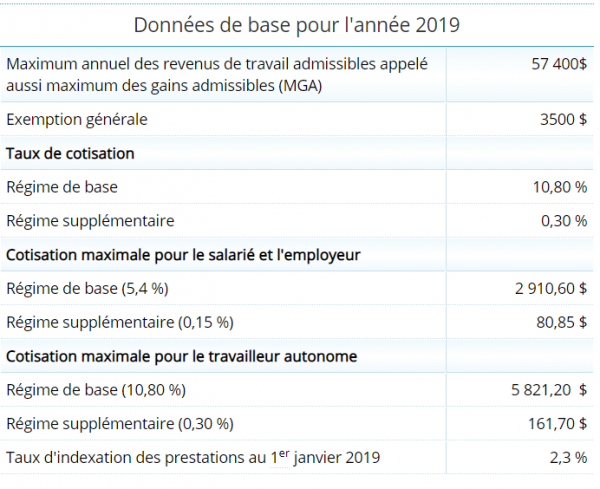

Her Excellency the Governor General in Council on the recommendation of the Minister of Finance pursuant to subsections 4 6 and 9 6 and section 39 of the Pension Benefits Standards Act 1985. The Québec Pension Plan is a compulsory public insurance plan for workers age 18 and over whose annual employment income is greater than 3500. Its purpose is to provide persons who work in Québec or have worked in Québec and their families with basic financial protection in the event of retirement death or disability.

The partial pension. You can get up to 1040 of the full pension if you live in Canada when you receive the pension and if you lived in Canada for a minimum of 10 years after your 18th birthday. For the old-age security pension the maximum monthly payment is.

From July to September 2021. 62649 for an income of less than 129 581. Règlement sur les prestations de pension RM.

2 Section 13 is amended in the part before clause a by striking out defined benefit plan or money purchase plan and substituting defined benefit pension plan o r a pension plan with a defin ed contribution provision. The Alberta Teachers Pension Plan the Plan is designed to provide teachers at age 65 and with 35 years of service with pensions worth 70 per cent of pre-retirement income 2 per cent of pre-retirement income multiplied by 35 years. When CPP came into effect in 1966 both CPP contributions and pension benefits were integrated into the Plan.

Foreign pension income unless the foreign pension income is tax-free in Canada because of a tax treaty or income from a United States individual retirement account. Part of what qualifies as eligible pension income is determined by your age. If you are 55 to 64 the only eligible pension income you will have is from a superannuation or pension.

Maximum Canada Pension Plan benefit rates as of January 1 2013. Type of Canada Pension Plan benefit. Maximum benefit rates for 2013.

Montant de la provision pour écarts défavorables going concern excess means in respect of a pension plan the amount if any by which the going concern as-. Individual pension plan 2 The Regulation is amended by adding before sec-tion 3 the following. 2 Le Règlement est modifié par ladjonction de ce qui.

A registered pension plan is a type of trust that provides pension benefits for an employee of a company upon retirement. Registered with the Canada Revenue Agency RPPs. With the new year underway recipients of Canada Pension Plan and old-age security benefits are getting a modest increase from the federal government.

The Ontario Securities Commission does not regulate the Canada Pension Plan CPP program. Specific questions and information requests related to CPP should be directed to Employment and Social Development Canada ESDC. In general the amount of CPP you receive depends on.

How much you have contributed to CPP and for how long and. Government pensions and benefits. Public pension plans provide a basic income in retirement.

You may be entitled to payments under the Canada Pension Plan CPP or the Old Age Security OAS program. The amount you receive from the CPP depends on how much and for how long you paid into the plan while OAS benefits are based on the number of years you have lived in Canada. Plus particulièrement le doublement progressif des prestations du Régime de pensions du Canada RPC et du Régime de rentes du Québec RRQ les faisant passer de 25 p.

100 à 50 p. 100 des gains moyens de carrière jusquà concurrence du montant maximum des gains ouvrant droit à.