Calculateur de prestations pour enfants et familles. The Canada Revenue Agency CRA administers these payments.

The refundable tax credit for Family Allowance is paid by the.

Allocation familial canada. Retraite Québec and Family Allowance. Retraite Québec administers the Family Allowance measure that is part of Québecs family policy. The Minister of Families is the minister responsible for Retraite Québec in matters related to the administration of the Family Allowance measure.

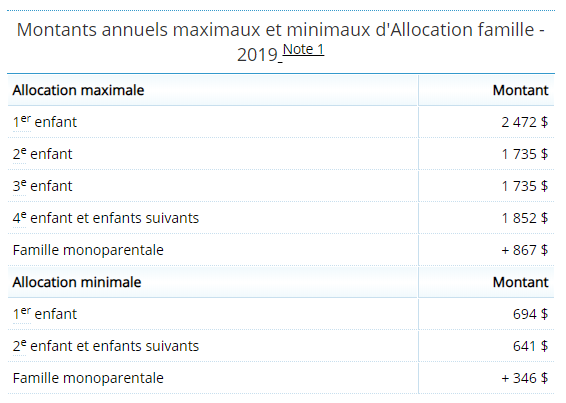

The Family Allowance in brief. The refundable tax credit for Family Allowance is paid by the. Since the calculation of the Family Allowance payment takes into account the total family income reported to Revenu Québec an income tax return must be filed each year even if one or both spouses have no income to report.

If an income tax return is filed late we can pay any amounts owing for a maximum retroactive period of 3 years. Your family income line 275 on your Québec income tax return and if applicable the amount indicated on line 275 of your spouses income tax return. Consult our My Account service to find out the exact Family Allowance amounts you will receive.

To access the service you will need your clicSÉQUR account. This online service. Calculateur de prestations pour enfants et familles.

Les versements de lACE supplément pour jeunes enfants ne sont pas pris en compte dans le calcul. Vous pouvez utiliser ce calculateur pour déterminer les prestations pour enfants et familles auxquelles vous avez droit ainsi que pour estimer le montant des versements. The Canada child benefit CCB is administered by the Canada Revenue Agency CRA.

It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. The CCB may include the child disability benefit and any related provincial and territorial programs. Includes Canada child benefit goods and services taxharmonized sales tax GSTHST credit their related provincial and territorial programs as well as Canada workers benefit and other federal programs.

These payments are meant to help individuals and families. The Canada Revenue Agency CRA administers these payments. The Optimal Allocation to Real Estate in Canada Greg MacKinnon PhD CFA Associate Professor of Finance Sobey School of Business Saint Marys University he last two decades have seen an increasing awareness amongst institutional investors of real estate as a viable asset class.

As of 2005 Canadian pension. The amount withheld from payments in order to repay a debt will be calculated according to the following rules. 50 of the payment if the annual family income is less than or equal to 35 000.

Note that we can withhold more than 50 of the payment if the amounts that remain to be paid are not sufficient to repay the debt. Québec Pension Plan retirement pension disability or death benefits Your pension will generally be paid on the last working day of the month. Payment dates in 2021.

Predictions of the collective familial decision-making model3 In this paper we propose and implement a novel quasi-experimental research design to assess the validity of the collective model of intra-household allocation decisions. According to the collective approach allocation 1 See Duflo 2005 for a recent survey. Set against the backdrop of an ageing population and the discourse surrounding old age risk and the welfare state this paper draws on 51 semi-structured life-history interviews to examine how mid- and late-life Canadians discuss and allocate responsibility for the provision of social financial and medical supports in later life.

132 Canadian Family Physician Le Médecin de famille canadien Vol 62february féVrier 2016 Clinical Review Update on age-appropriate preventive measures and screening for Canadian primary care providers documentation. After reading this article providers will be able to list the evidence-based recommendations for preventive maneuvers in healthy adults of different ages. Familial hypercholesterolemia FH is the most frequent genetic lipoprotein disorder associated with premature CAD.

In Canada the burden of disease is estimated to be approximately 83500 patients. The goal of this initiative is to create a registry of subjects with FH across Canada. Rare diseases of lipoprotein metabolism will also be included.

LAllocation canadienne pour enfants est une prestation mensuelle non imposable versée aux familles admissibles pour les aider à subvenir aux besoins de leur. Allocation de soutien familial Asf Demande complmentaire tiersrecueillant1498901Art. L5231 L5233 et L5811 10 et R5231 R 5238 et R.

Lallocation pour le congé parental ou familial - lallocation de foyer eur-lexeuropaeu allowance fo r pa renta l o r family l eav e - he ad of ho use hold allowance. Aide financière plus généreuse pour les familles du Québec. Un 1er versement dès le 15 mars.

Par la suite ces sommes bonifiées seront intégrées au paiement. Contact Global Affairs Canada. Global Affairs Canada manages Canadas diplomatic relations provides consular services to Canadians promotes the countrys international trade and leads Canadas international development and humanitarian assistance.